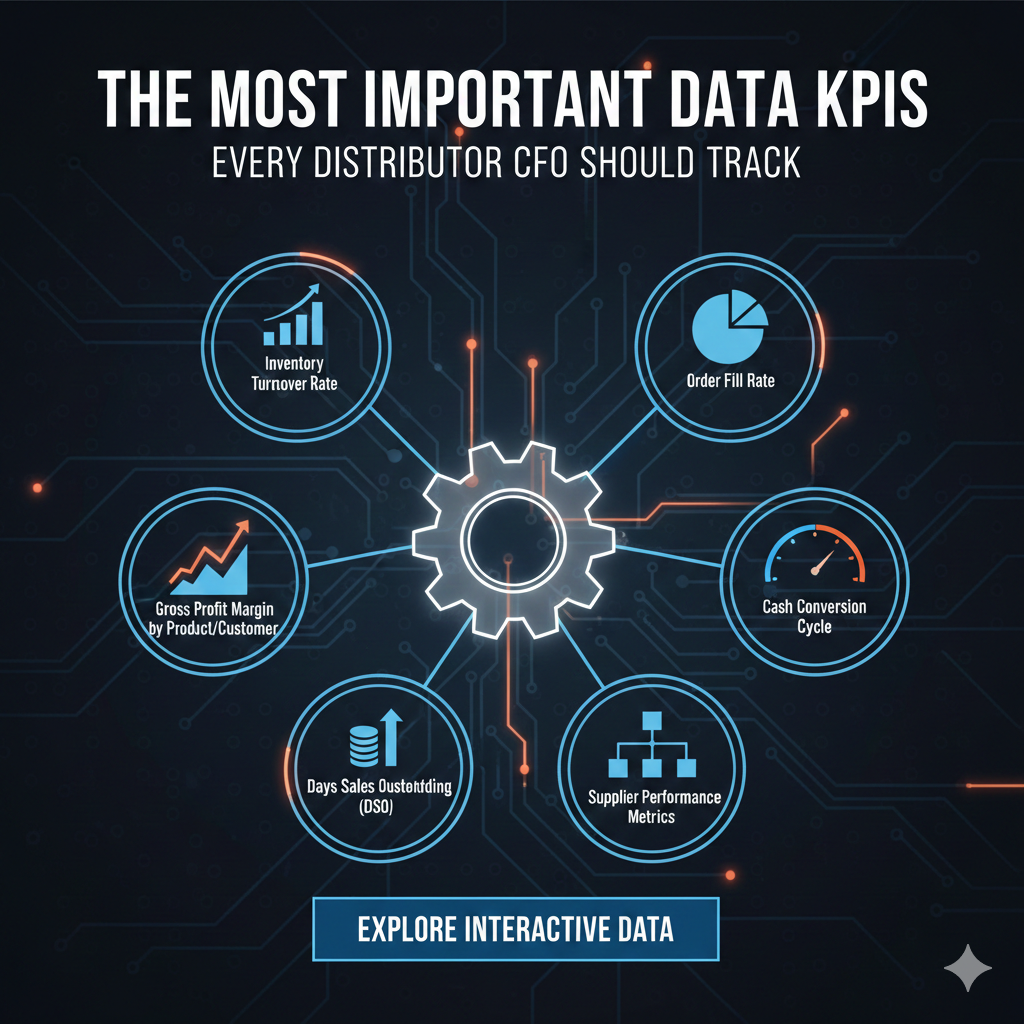

The Most Important Data KPIs Every Distributor CFO Should Track

In today’s data-driven distribution landscape, the role of the CFO has evolved far beyond traditional accounting. Distributor CFOs are now expected to deliver real-time insights, protect margins, optimize cash flow, and support strategic growth decisions. The difference between reactive and high-performing finance teams often comes down to one thing: tracking the right KPIs and using them effectively.

This article outlines the most important data KPIs every distributor CFO should track, why they matter, and how using them together can unlock stronger financial performance. We’ll also touch on how structuring and visualizing these KPIs correctly can improve decision-making across the organization.

Why KPIs Matter More Than Ever for Distributors

Distributors operate on thin margins, high inventory volumes, and complex supplier and customer relationships. Small inefficiencies slow collections, excess stock, margin leakage can quietly erode profitability.

Well-defined KPIs help CFOs:

Detect issues early, before they impact cash or margins

Align finance, operations, and sales around the same metrics

Support leadership with data-backed forecasts and scenarios

Scale reporting without increasing manual effort

Tracking KPIs isn’t about having more reports it’s about having the right metrics, refreshed frequently, and trusted across teams.

1. Revenue Growth Rate

What it measures:

The percentage increase or decrease in revenue over a defined period.

Why it matters:

Revenue growth indicates market demand, sales effectiveness, and pricing strength. For distributors, it’s especially important to segment this KPI by:

Product category

Customer type

Region or channel

This helps CFOs identify where growth is coming from and whether it’s profitable growth.

Pro tip: Pair revenue growth with margin KPIs to avoid chasing unprofitable volume.

2. Gross Margin (and Margin by SKU / Customer)

What it measures:

Revenue minus cost of goods sold (COGS), expressed as a percentage.

Why it matters:

Gross margin is often the single most important KPI for distributor CFOs. Margin erosion can come from:

Supplier price increases

Discount-heavy sales behavior

Freight and logistics cost creep

Tracking margin at a granular level by SKU, customer, or salesperson reveals hidden profit leaks that headline margins won’t show.

3. Inventory Turnover

What it measures:

How many times inventory is sold and replaced over a given period.

Why it matters:

Inventory is often the largest balance-sheet item for distributors. Low inventory turnover means:

Cash tied up unnecessarily

Higher storage and obsolescence risk

Reduced flexibility during demand shifts

A healthy turnover rate indicates efficient purchasing and strong alignment between sales forecasts and inventory planning.

Best practice: Track inventory turns by category, not just in aggregate.

4. Days Inventory Outstanding (DIO)

What it measures:

The average number of days inventory is held before being sold.

Why it matters:

DIO complements inventory turnover by translating stock efficiency into time. CFOs use DIO to:

Compare performance across periods

Identify slow-moving or dead stock

Support working capital optimization initiatives

Lower DIO generally means better cash flow but only if service levels remain strong.

5. Days Sales Outstanding (DSO)

What it measures:

The average number of days it takes to collect payment after a sale.

Why it matters:

DSO directly impacts cash flow. Even profitable distributors can struggle if collections lag behind sales.

Monitoring DSO helps CFOs:

Spot customer payment issues early

Improve credit policies

Coordinate finance and sales around collections

Actionable insight: Segment DSO by customer and payment terms, not just overall averages.

6. Days Payable Outstanding (DPO)

What it measures:

The average number of days the company takes to pay suppliers.

Why it matters:

DPO plays a critical role in working capital management. While extending payables can improve short-term cash flow, it must be balanced against:

Supplier relationships

Early-payment discounts

Supply chain reliability

The goal isn’t to maximise DPO, but to optimise it strategically.

7. Cash Conversion Cycle (CCC)

What it measures:

The number of days it takes to convert inventory investments into cash.

Formula:

CCC = DIO + DSO − DPO

Why it matters:

The cash conversion cycle brings inventory, receivables, and payables together into a single, powerful metric. A shorter CCC means:

Better liquidity

Lower financing needs

Greater resilience during market downturns

Many CFOs use CCC as a top-level KPI to track working capital efficiency over time.

8. Operating Expense Ratio

What it measures:

Operating expenses as a percentage of revenue.

Why it matters:

As distributors grow, operating costs can quietly scale faster than revenue. This KPI helps CFOs:

Monitor cost discipline

Benchmark performance against peers

Evaluate automation and process improvements

Tracking this ratio by department can highlight where efficiency gains are possible.

9. Forecast Accuracy

What it measures:

How closely financial forecasts match actual results.

Why it matters:

Accurate forecasting supports better inventory planning, staffing, and capital allocation. Poor forecast accuracy often signals:

Inconsistent data sources

Manual reporting processes

Limited visibility into leading indicators

Improving forecast accuracy is often less about better spreadsheets and more about better data integration.

10. EBITDA and EBITDA Margin

What it measures:

Earnings before interest, taxes, depreciation, and amortization, and its percentage of revenue.

Why it matters:

EBITDA provides a clean view of operating performance and is commonly used by lenders and investors. For distributor CFOs, tracking EBITDA margin over time helps assess:

Core business profitability

Impact of cost structure changes

Readiness for financing or M&A activity

Turning KPIs Into Actionable Insights

Tracking KPIs is only the first step. High-performing distributor finance teams focus on:

Data consistency: One source of truth across ERP, CRM, and accounting systems

Visualisation: Dashboards that highlight trends, not just numbers

Context: KPIs presented with benchmarks, targets, and historical comparisons

This is where modern data analytics platforms can dramatically reduce manual reporting while increasing confidence in the numbers.

Final Thoughts

For distributor CFOs, the right KPIs provide clarity in an otherwise complex operating environment. By focusing on margin, inventory efficiency, cash flow, and forecast accuracy, finance leaders can move from reactive reporting to proactive strategy.

At Intuitico, we help distributors turn fragmented operational and financial data into clear, decision-ready insights without adding complexity to finance teams.

Ready to Get More Value From Your Data?

If you’re looking to improve KPI visibility, streamline reporting, or gain deeper insights into your distribution business, we’d love to help.

Visit our website: https://intuitico.io

Or email us directly to start the conversation at “will.chen@intuitico.io”

For a free 30 minutes consultation, you can book a meeting using this link:

”https://calendly.com/will-chen-intuitico/30min'“