Same Region, Different Story: Why a Scalpel Sales Approach Wins

If you are a building materials wholesaler in Texas, "business as usual" can quietly become your most expensive habit.

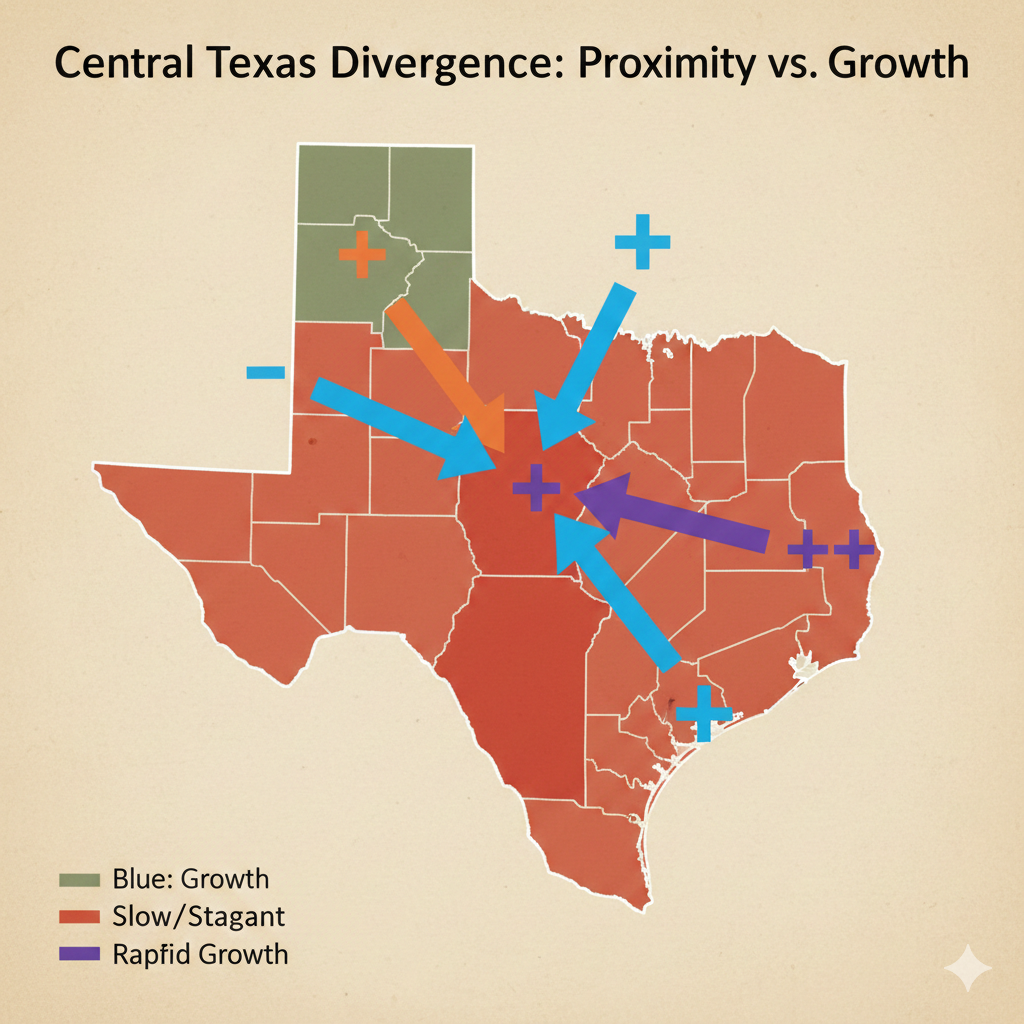

We often hear leaders talk about “the Texas market” as if it were a single, predictable organism. In reality, Texas behaves more like a collection of micro-economies- sometimes moving in opposite directions even when counties sit right next to each other.

A clear example comes from home improvement loan activity in Bexar, Travis, and Hays counties. These counties are geographically close, share supply routes, and often overlap contractor networks yet their demand signals, growth trajectories, and sales opportunities look very different.

For wholesalers still deploying broad, one-size-fits-all sales strategies, this gap translates directly into wasted overhead, misaligned territories, and missed revenue.

This is where a scalpel sales approach not a hammer wins.

The Problem With Treating Texas as One Market

From the outside, grouping nearby counties together feels efficient:

One regional sales plan

Shared pricing assumptions

Uniform inventory strategies

But proximity does not guarantee similarity.

Consider what often varies county by county:

Permit volume and renovation intensity

Home equity availability and loan utilization

Contractor mix (remodel-heavy vs. new construction)

Price sensitivity and product preferences

When these differences are ignored, sales teams are forced into reactive mode chasing leads that don’t convert, over-servicing low-potential areas, and under-investing in high-growth pockets.

A Closer Look: Bexar, Travis, and Hays Counties

Although these counties sit within the same broader Central Texas region, recent home improvement loan data shows distinct and diverging patterns:

One county may be cooling, with homeowners pulling back on discretionary renovation spend.

Another may be accelerating, driven by higher household income, inbound migration, or aging housing stock.

A third may show volatility, with sharp month-to-month swings that require tighter sales timing and inventory discipline.

Treating these three counties with the same sales coverage model, targets, and messaging is not conservative it’s costly.

What a “Scalpel” Sales Approach Really Means

A scalpel sales approach replaces broad regional assumptions with data-backed precision. Instead of asking, “How is Texas doing?”, the better questions become:

Where is demand actually rising?

Which counties justify deeper sales coverage and which do not?

Where should inside sales support replace field visits?

Which products deserve priority by micro-market?

This approach allows wholesalers to:

Align sales effort with true opportunity

Reduce travel and labor inefficiencies

Improve win rates without increasing headcount

Precision does not mean complexity it means focus.

How Data Turns Guesswork Into Strategy

The most effective distributors are no longer relying on anecdotal feedback alone. They are combining:

Home improvement loan data

Permit and housing activity

Historical sales performance

Drive-time and territory coverage analysis

When layered together, these datasets reveal where sales resources should be tightened, expanded, or redeployed.

For example:

A county with rising loan activity but flat sales may indicate under-coverage

A heavily serviced county with declining renovation spend may signal over-investment

Without this visibility, sales strategy becomes reactive. With it, decisions become proactive and defensible.

Why This Matters More in 2026 Than Ever Before

Margin pressure is not easing. Labor costs remain high. Customers are more selective.

In this environment, growth does not come from doing more it comes from doing the right things in the right places.

Wholesalers who continue to deploy blanket regional strategies will feel this pressure first. Those who embrace micro-market intelligence gain a quiet but powerful advantage.

What This Means for Texas Wholesalers

If your sales plan still treats Bexar, Travis, and Hays counties the same, it may be time to pause and reassess.

The opportunity isn’t to work harder it’s to work sharper.

A scalpel sales approach helps you:

Protect margins

Reduce wasted overhead

Capture demand where it actually exists

Final Take

Same region does not mean same story.

In markets as large and dynamic as Texas, precision beats scale. The wholesalers who win next are not the ones with the biggest footprint but the ones with the clearest focus.

Ready to sharpen your sales strategy?

Visit https://intuitico.io to learn how data-driven market insights can help you deploy your sales resources with precision.

Have questions or want to explore how this applies to your business? Email us directly at “will.chen@intuitico.io“ we’d love to talk.

For a free 30 minutes consultation, you can book a meeting using this link:

”https://calendly.com/will-chen-intuitico/30min”